Incorporation is a significant step for the business owner to make, with the potential for significant benefits – personally and for the business itself. Before considering financial effects, it is useful to consider the wider advantages & disadvantages to incorporation.

|

Issue

|

Sole Trader

|

Limited Company

|

Advantage

|

|

Start-up costs

|

It is free to register as a sole trader with HMRC

|

There is a cost – although this can start from just £12 for a simple web-based set registration of a company with Companies House.

|

Sole Trader

|

|

Privacy

|

Your name, address & personal details such as your month & year of birth remain private.

|

As a director or shareholder, you are required to provide Companies House with your details which will be made available to the public.

Your shareholding will be made public as well financial details of your business (via annual accounts filings – or other required disclosures).

|

Sole Trader

|

|

Business Control

|

You can make all the decisions without needing to consult shareholders or partners.

|

Not only do you need to consult shareholders or partners – but in some cases you need to formally arrange a meeting, vote on a proposal, minute the decision & even file some forms with Companies House

|

Sole Trader

|

|

Access to Profits

|

You retain all the profits that you make after you’ve paid tax.

|

Legally, it’s not YOUR money!

Even if the company has made a profit, you can only take dividends from the company if it has sufficient funds and distributable reserves to make that payment.

All shareholders must be paid at the same time in proportion to their shareholdings

|

Sole Trader

|

|

Paperwork

|

Very Little - you submit an annual self-assessment tax return.

You do not file Statutory Accounts

You do not pay Corporation Tax

If you have no employees, you won’t need a payroll

Whilst you must keep records of your business income & expenses, these tend to be less complex than for a limited company

Simplified accounting processes can be adopted (e.g. cash receipts basis)

|

More Complicated – as a shareholder-director you will still have to file that self-assessment tax return

Your company also files Statutory Accounts

Your company pays Corporation Tax

You will be running a payroll – at the very least for yourself

Not only do you need to keep more complex records - but you also need to retain minutes of meetings and company resolutions (and for longer periods). Dividend vouchers, bank interest certificates, and Construction Industry Scheme (CIS) vouchers can’t be digitalised and must be retained as hard copies.

Accounts must be prepared in accordance with specific accounting standards

There’s extra paperwork such as an annual Confirmation Statement for Companies House.

|

Sole Trader (Significantly)

|

|

Business Name

|

Anyone can trade under the same name as you which could cause confusion &/or reputational damage.

|

Your business name is protected as Companies House do not allow exact duplicates of company names

|

Limited Company

|

|

Debts and legal risks

|

All business debts are your own personal debts.

You may need to sell off personal assets such as your house to pay those debts.

In most cases, professional indemnity insurance should be sufficient to protect you from those risks in most sole trades.

|

A limited company is a legally separate entity – its debts are not yours as a shareholder or a director

Your personal assets are safe (unless you are required to be a personal guarantor for your company)

Directors have a variety of legal duties which can still result in them being personally liable financially for wrongful acts or breaches of duties

Liability or Indemnity insurance is still likely to be needed to protect the company & directors

|

Limited Company

|

|

Credibility

|

Some businesses prefer not to work with non-limited companies due to the relative lack of legal protection.

|

Limited company status can give more confidence to suppliers and customers.

|

Limited Company

|

|

Funding

|

Raising business finance can be more difficult as lenders and investors tend to favour limited companies. This means the business growth could be slower.

|

Lenders and investors tend to favour limited companies due to the level of legal protection and tax benefits.

|

Limited Company

|

Still interested – then when is it appropriate to consider incorporating your business from a financial perspective?

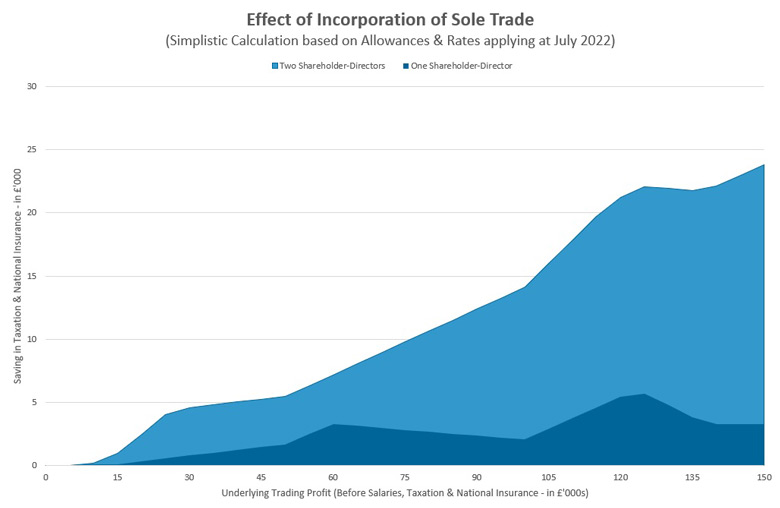

A simple tax calculation might suggest a sole trader transferring their business to a single shareholder company structure could benefit from incorporation once their taxable profits exceed £15,000. However, at that level of income, the additional administration & costs of Companies House fees, additional accountancy & software are likely to outweigh any tax & national insurance savings.

Active Participation by Spouse

If your sole-trading profits are around £20,000, you may wish to consider inviting your spouse to take an active role in your company as a partner if they have no other source of income. Thereby you take advantage of two personal allowances, dividend allowances and tax bands.

A shareholder’s agreement is advisable if there is more than one director-shareholder to provide for any disputes that may arise in the future. Relative shareholdings and salary, reflective of business involvement & experience, are considerations that need careful consideration.

In 2022-23, if the company has two shareholder-directors both paid more than £758 per month (the Class 1 NI secondary threshold), an employment allowance can generally be claimed reimbursing employers NI liabilities – which is not available to single director-shareholder companies. Restrictions apply to companies with significant turnover derived from the public sector, earnings within “IR35” rules & recipients of other forms of state aid.

Re-Investment of Profit & Timing of Dividends

The graph above is based on a simple assumption that all profit is distributed to shareholder-directors. However, whilst the company pays corporation tax on its profits – the company directors can choose when to receive any dividends. Unlike the sole trader, whose profits are personal income, any personal taxation liability on a dividend distribution will only arise when dividends are received. By leaving profits in the company for further growth, more tax can be saved compared to the sole trader – who is taxed irrespective of whether the profit is re-invested.

Loan Balances arising on Asset Transfers

If you have run your sole trade business for several years, it is likely that you will have existing assets & liabilities that will be transferred to the new company – this may include tools & equipment, stock and outstanding debts & liabilities. In addition, the new company will need some funding from the previous sole trade bank account.

Transfer of assets must be made at market value – consequently, where capital allowances have been claimed on any tools & equipment in previous years a significant balancing adjustment may feature in the final set of sole trader accounts

If the valuation of the sole trade exceeds the net assets transferred goodwill will arise, which has capital gains tax implications – for which a variety of reliefs may be available

Assuming a very simple case, where the sole trade is less established and goodwill non-existent, a simple loan balance repayable to the shareholder-director/s may arise in the new company. To the extent that this liability is not reimbursed then it is possible to charge the company interest on the loan at an appropriate commercial rate. This is allowable against company profits – thereby further saving corporation tax.

HMRC allow individual taxpayers a personal savings allowance of £1,000 (2022-23) against which any gross interest received from the company can be offset – which further increases personal tax savings.

However, be aware that this does introduce additional administrative burdens & costs - additional HMRC reporting is required – and tax must be deducted from interest at the time of payment (though this can be recovered via the personal taxpayer’s self-assessment tax return)

Allowable Expenses

There are significant areas in which the additional expenses can be charged in a company structure to reduce taxable profits, that are simply not available to the sole trader. We only consider just two common & one less common case here:

Mobile Telephones

Its common for mobile contracts to involve a fixed monthly charge for a certain maximum number of minutes, texts or gigabytes of data access.

- Sole Trader: If the mobile is used for personal & business purposes, then only that proportion of the cost identifiable as business can be claimed against profits – practically this requires a robust breakdown & analysis of actual calls to allocate the cost between business (claimable) & private use

- Company: In most circumstances, the provision of one mobile phone to a director/employee for private use is exempt from a benefit in kind charge on the director/employee and the costs allowable in full against corporation tax. The exemption covers the phone itself, any line rental and the cost of all calls (including private calls) paid for by the employer on that phone.

Broadband

Similar bundle considerations apply as for mobile telephones and need to be considered on a case-by-case basis. Where a user relies on a mobile telephone, they may or may not have a landline telephone – with broadband solely used for internet & email connectivity (via mobiles & computers) and for streaming television services.

- Sole Trader: If the mobile is used for personal & business purposes, then only that proportion of the cost identifiable as business can be claimed against profits – practically this requires a robust breakdown & analysis of actual calls to allocate the cost between business (claimable) & private use

- Company: You can deduct the costs associated with setting up a broadband contract for your work premises, including your own or employee home offices (as long as the contract is in your limited company’s name). However, as in the case of mobiles – it is important to note that for the claim to be allowed, it’s got to be primarily for business use. HMRC will accept some occasional personal use, but you must be able to demonstrate the expenses associated with a given broadband contract are in some way required for maintaining business operations.

Cycle Travel

A less common situation:

- Sole Trader: If you use your bicycle for business travel purposes you are not able to claim tax relief on business journeys undertaken personally. If you employ someone, who does this they can claim tax relief!

- Company: As a salaried employee or director you can claim a tax-free rate of 20p per mile for the use of your bicycle for business travel purposes. However, just as with motor mileage rates you cannot claim for travel between home and your normal place of work.

Other allowable expense savings are available!

Summary

Incorporation is a significant undertaking. Oligomer can assist you with any review you wish to undertake to determine if incorporation has any advantage to you in the unique circumstances of your own business. We can help with the incorporation process and management of your additional reporting & filing needs.