Making Tax Digital (MTD) is a United Kingdom Government initiative designed to assist individuals and businesses to correctly report their taxable income and keep on top of their affairs.

HMRC’s ambition is to be “one of the most digitally advanced tax administrations in the world”. They plan to join up their internal systems, creating a single account for each taxpayer for all their different taxes. Via this 'digital account' taxpayers will be able to view all their payments and liabilities and offset overpayments in one tax against underpayments in another. MTD is already fundamentally changing the way the tax system works with the intention that tax administration becomes more effective, efficient & easier for taxpayers to get their tax right.

Whilst most taxpayers want to get their tax right, HMRC estimate the shortfall between expected tax income and actual receipts in 2020-21 at £32 billion (the “Tax Gap”), with £15.6 billion relating to small businesses. HMRC believe that the improved accuracy that digital records provide, along with controls built into many software products and the fact that information is sent directly to HMRC from the digital record should reduce errors & hence contribute to reducing the tax gap.

The Journey So Far: MTD for VAT

The initiative was originally announced in 2015, with the then Chancellor, George Osborne announcing the death of the annual self-assessment tax return in his March Budget. In the future, taxpayers would report income quarterly & digitally – all through MTD-enabled software.

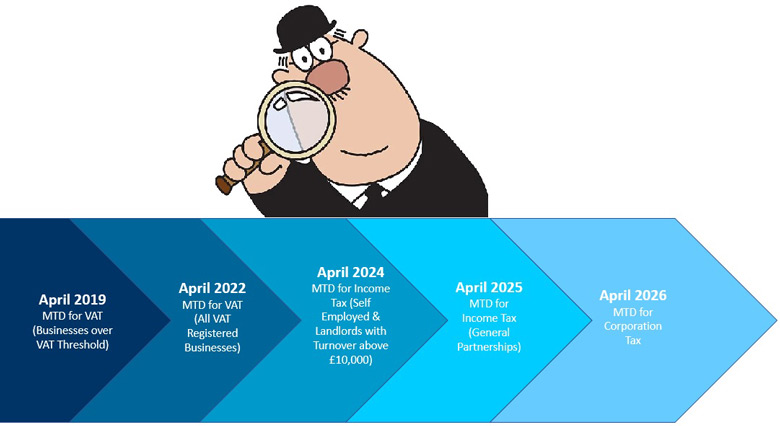

In the first wave of MTD in April 2019 businesses with turnover above the VAT threshold of £85,000 were required to retain digital records and submit VAT returns using 'functional compatible software'. Rules were extended from April 2020 to require digital links to be implemented between software programs, applications or products supporting VAT reporting to create an end-to-end digital reporting process & thereby minimise human intervention and the prospect of errors.

From April 2022, MTD for VAT was expanded to include all VAT registered businesses, including those below the VAT registration threshold.

Oligomer has extensive experience with VAT reporting & Xero is fully compatible with MTD for VAT.

Next Step: MTD for Income Tax

The second wave of MTD will affect every self-employed individual, landlord and partnership in respect of their Income Tax obligations:

- From 6 April 2024, self-employed individuals and landlords with business turnovers over £10,000 pa will be required to report under MTD for Income Tax. The £10,000 pa limit applies to the sum of an individual’s gross income from all sole trade & property sources. This implementation has been extended already by a year.

- From 6 April 2025 reporting requirements will be extended to general partnerships, with other types of partnerships affected later – at a date yet to be confirmed.

Five Tax Returns Each Year

Under MTD, HMRC will require quarterly returns during the year. All taxpayers will be required to provide actual income & expense information that conforms to the following quarters:

|

Quarter

|

Period

|

Deadline

|

|

1

|

6 April - 5 July

|

5 August

|

|

2

|

6 July - 5 October

|

5 November

|

|

3

|

6 October - 5 January

|

5 February

|

|

4

|

6 January - 5 April

|

5 May

|

HMRC will allow taxpayers to make an election for the periods to be calendar quarters instead of the dates shown. This will stay in place until withdrawn but will not affect the deadlines.

An End of Period (EOP) statement will then need to be filed by 31 January following the end of the relevant tax year unless exceptions apply. It is expected that HMRC will pre-populate some of the EOP figures e.g. bank interest, income from employment, pensions, etc and ultimately it may also attempt to use self-employment & property data submitted in the quarterly returns.

Taxpayers will need to check any pre-populated data and confirm that all information is correct and complete to the best of their knowledge.

Accounting & Basis Period

Most sole traders typically already use the tax year for both their accounting and tax basis period. As such the above changes will not affect their tax liabilities for 2023-24 and following tax years

However, if they use a different accounting period, such as a year ending 31 December, then 2023-24 will be a tax year generating additional transitional taxable profits after the accounting period end. For most businesses, this could mean drawing up two sets of accounts: one up to the end of the existing basis period, and transitional accounts drawn up to 31 March or 5 April 2024 – or alternatively extending their accounting period to align with the tax year.

Businesses will also need to take account of their original first year overlap profits to prevent double taxation – this might be difficult to identify if the business has been established for a significant period & HMRC may need to be approached for this information.

From 2024-25 tax year, the tax year must be used as the basis period. Businesses will be liable for profits arising in the actual tax year - overlap profits or adjustments will no longer exist.

This basis period reform will affect all unincorporated businesses—even those unaffected by MTD for Income Tax on 6 April 2024.

Separate Returns for Each Income Type

Under MTD, HMRC will require separate quarterly returns & an End of Period statement for each source of income.

As a practical example – a self employed individual who carries on two separate trades, each with a business turnover of £2,000 pa, who also rents out a property for £6,000 pa would be required to report returns for 3 separate income sources (2 sole trades + property)

That’s fifteen returns & fifteen reporting deadlines in respect of the tax year!

Tax Payments

Tax liabilities will need to be paid by the 31 January following the tax year, as they are currently.

For businesses impacted by larger tax liabilities arising from extra transitional profits, HMRC will be offering transitional relief – with the extra tax liability capable of being paid over the following five years.

You will be allowed to voluntarily pay your taxes as you go – the means is still being considered.

Whilst there are no immediate plans to do so, it is possible that eventually you may be required to make four payments per year on account of tax.

Penalties

There will be no late filing penalties for at least a year while the new system beds in. After that, a new penalty regime will apply whereby you will accrue penalty points if you file your returns late.

These points will stay on your record for 24 months. Following 4 missed quarterly submission deadlines a £200 penalty will be charged & when a penalty is triggered those points stay on your record until you have been compliant for twelve months & have submitted all outstanding returns.

The same penalty account applies to all income sources affected by MTD for Income Tax.

Additional penalties already apply for errors in returns or documents

HMRC has also introduced a new late payments penalty system, which is automatically applied if you fail to pay on time.

|

Days Overdue

|

Penalty

|

|

0 - 15

|

No Penalty

|

|

16 – 30

|

2% of outstanding balance at day 15

|

|

31

|

Day 15 penalty above + 2% of outstanding balance on day 30

|

|

31+

|

Day 31 penalty above + a penalty calculated daily using an annual rate of 4% on the outstanding balance

|

These late payment penalties are additional to interest charged on the outstanding debt at a rate of 2.5% above the Bank of England base rate.

Software & Equipment

The government's published policy paper on MTD for Income Tax estimates there will typically be a transition cost of £330 and an annual cost of £35 for each affected business.

Consider your own requirements:

- Software – the taxpayer will need to maintain digital records of all transactions to form the basis of the quarterly returns. If you are not already using software for record-keeping & accounting, you will need to invest in MTD-compliant software or an app. HMRC will not provide this though some free, third-party software will be available. If you are still tracking your own costs & income with spreadsheets – or providing your accountant with a box of receipts or emails with attachments at year end you will need to change your processes

- Internet Connection – this will need to be reliable as you will be using it to file much more frequently

- Data Storage – you will need some facility in which to store your data. This may or may not be the software you use to make MTD-submissions

- Equipment – you may need to consider upgrading your existing mobile to a smartphone if you intend to use an app – or may need to invest in a personal computer

HMRC’s expectation is that taxpayers will learn tax deduction rules on a day-to-day basis, prompted by their software or apps. They intend to provide guidance online as opposed to providing telephone support.

Exemptions

There are a few limited exemptions from MTD for Income Tax – for example, if you are unable to handle it due to age, disability or location or if it is contrary to your religion. However, you will need to satisfy HMRC first before they will agree to the exemption.

Oligomer Can Help

Oligomer is familiar with the planned changes and can support you with your transition to MTD for Income Tax. Talk to us today!

Future Steps: MTD for Corporation Tax

The third wave of MTD will affect every company in respect of their Corporation Tax obligations:

- From April 2024 companies can start using an MTD for Corporation Tax pilot scheme.

- From April 2026 companies join MTD for Corporation Tax.

Information will be provided as this becomes available.